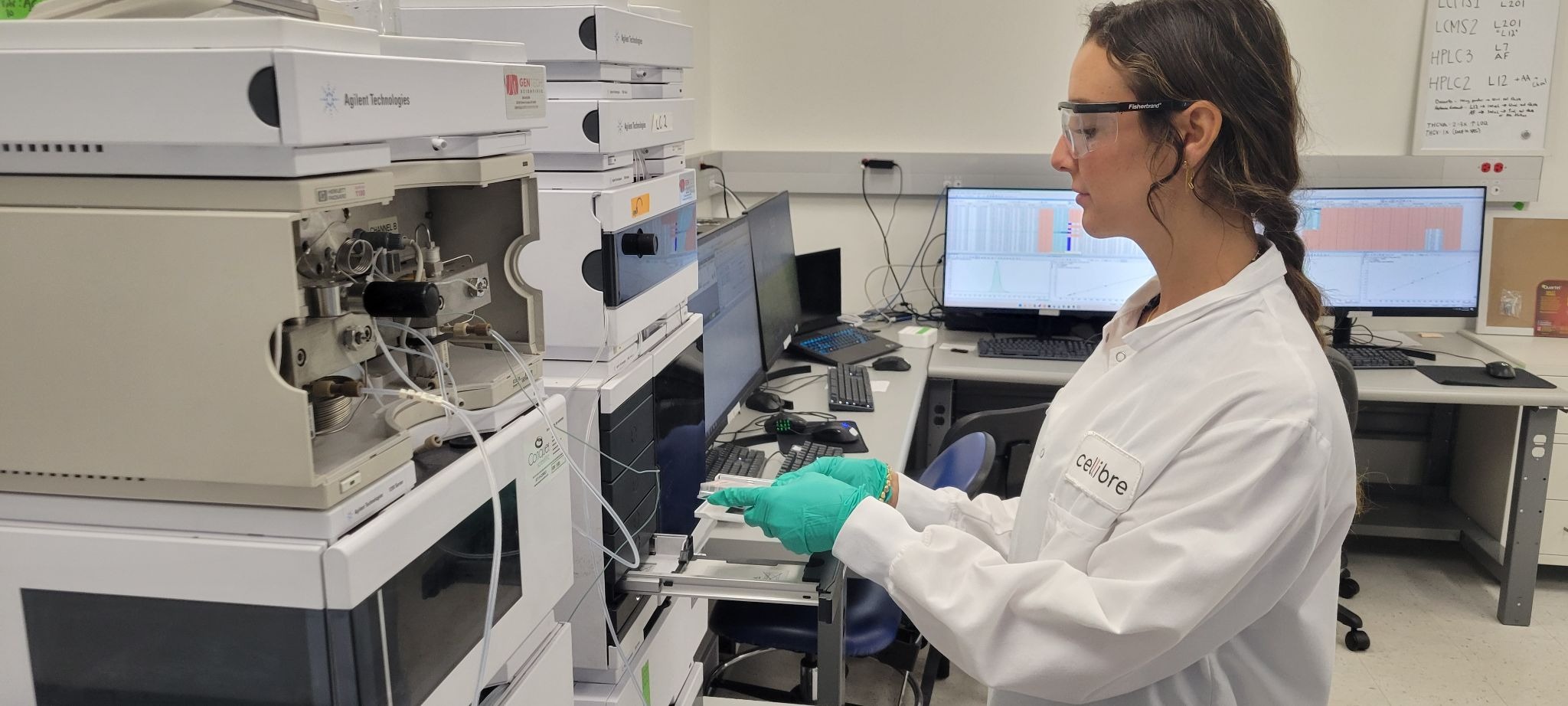

Image via Cellibre

Global ingredients giant Symrise is backing Cellibre with a strategic equity investment to apply precision fermentation in taste and cosmetic bioactives. By combining Symrise’s global reach with Cellibre’s agile, world-class R&D, the two companies aim to bring new technologies that provide quality, affordability, and sustainability.

“This is not an announcement about products we might bring to market someday or a vague R&D partnership,” said Cellibre CEO Benjamin Chiarelli. “Symrise came to Cellibre because we are both ready to deliver for our customers today. This isn’t ‘we might someday’ news—it’s a ‘here we come’ announcement".

Cellibre’s approach starts with the molecule first. They pick targets where biology will beat legacy means on price, quality, and supply resilience, and then select a cell chassis to engineer where nature has already done some of the heavy lifting. They have successfully de‑risked core elements of scale‑up with impressive capital discipline. “Cellibre has built what we believe to be the world’s best biotech platform for the manufacture of plant‑based compounds,” said Chiarelli, “Specifically, our naringenin platform is achieving KPIs many multiples better than anything else we have seen. This platform is a hub chassis for hundreds of very interesting natural and new‑to‑nature ingredients.”

Symrise, the 4th largest flavours and fragrances company by global market share, brings deep regulatory experience and access to customers where consistency and performance matter. “For Cellibre, the commercial infrastructure, the innovation know‑how, and the market insights that Symrise brings to the table are invaluable,” said Chiarelli. “Together, we can rethink how a wide range of ingredients are made—and bring to market innovations our customers didn’t know were possible.”

For Symrise, the upside is preferred access to a differentiated fermentation platform and greater supply chain consistency and resilience. Customers want to source ingredients and bioactives without having to deal with seasonal and cultivation variability. This partnership meets that urgency. “The timing is ideal. Market demand for biotech-driven solutions in cosmetics and food & beverage is accelerating,” said Imke Meyer, Project Lead for Biotechnology at Symrise. “Cellibre has demonstrated the technological maturity as well as the scalability of their platform.”

For Cellibre, success in biomanufacturing starts with unit economics, not chasing the biggest addressable market or relying on a single chassis. The company’s strategy is built around choosing molecules where biology can outperform traditional chemistry or agriculture on cost, quality, and resilience. “We want to build monopolies one molecule at a time. When we come into a market, we are coming in to own it and to win on every metric that matters for our customers” said Cellibre, “While most companies have built massive amounts of automation and infrastructure around specific cell chassis --- baker’s yeast, E. coli, Algae, etc. --- we take a product first approach.” The result is a leaner, more adaptable R&D model designed to develop scalable technologies faster and with far less capital as well as higher returns on that capital than many of its peers.

Chiarelli also adds that sustainability should be seen as a byproduct of better processes, not the main reason to buy. “Sustainability has to be the icing on the cake, not the lead differentiator for our industry,” he said. Performance and price must stand on their own.

Over the next 12 months, the partners plan to convert platform maturity into first product launches, starting with taste modulation and cosmetic actives. “Our focus is on supporting the first commercial launches from Cellibre’s biotech platform, particularly in taste modulation and cosmetic ingredients,” Meyer said. The near‑term brief is pragmatic. Hit cost and quality targets, prove reliability, and establish a repeatable launch engine.

Further out, they hope to bring products that win on fundamentals and a pipeline that keeps them coming. “Delivering our shared customers higher quality, more cost‑effective ingredients via a more resilient and sustainable supply chain. Period. We are checking all the boxes, not just one”, said Chiarelli.

If successful, Symrise × Cellibre could become a model for how precision fermentation moves from promise to production. Real products, real prices, and real markets.

Read More

Newletter & More

SynBioBeta

Join the innovators shaping the future with SynBio + AI. From health to ag, materials & more—be part of the revolution.