Bioeconomy Policy

Capital Markets

Engineered Human Therapies

Biopharma Solutions Tools Tech

Bio Design

The Year China Surpassed the USA in Biotech Innovation, Deal Value, and Clinical Output

China has emerged as a leader in biotech innovation, surpassing the U.S. in deal value and clinical trial output during JPM2026.

China was the undeniable winner of JPM2026. During the conference itself, Chinese biotech firms closed the most deals, totaling approximately $7.3 billion—dwarfing the week's combined $1.5B–$2B in AI infrastructure bets. While the industry discussed the potential of AI, it spent its actual capital on Chinese-originated assets, particularly ADCs and multispecific antibodies.

This deal flow reflects a deeper structural shift that solidified in 2025:

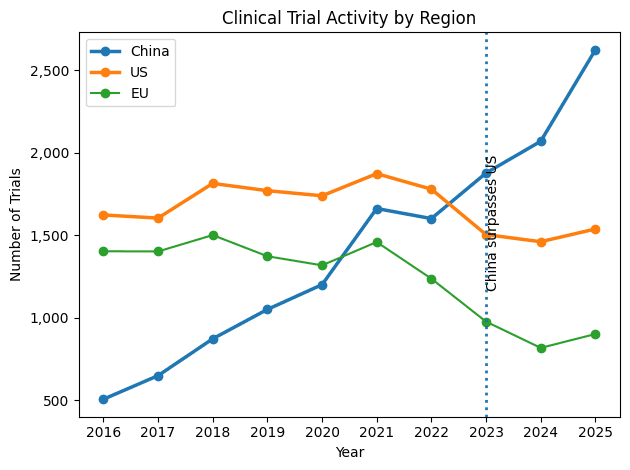

Clinical Scale & Speed: China surpassed the U.S. in total clinical trial volume in 2021 and has widened the lead annually. By 2025, China reached ~7,100–7,700 trials versus ~6,200–6,300 in the U.S., expanding the annual gap to ~1,300–1,500 trials. Regulatory speed shifted in parallel: China’s first-in-human approval timeline fell from 501 days (pre-2015) to 87 days today. With a 30-working-day objection-based IND review and high patient density, Phase I trials that often take two years in the U.S. are frequently completed in nine months in China.

Pipeline Gravity: China’s share of global innovative drug candidates rose from 8% in 2018 to 30% by 2026, while the U.S. share declined from 47% to 36%. In 2024, China became the world’s second-largest source of first launches for new molecular entities (18% share). This execution is fueling a market projected to reach $262.9B by 2030.

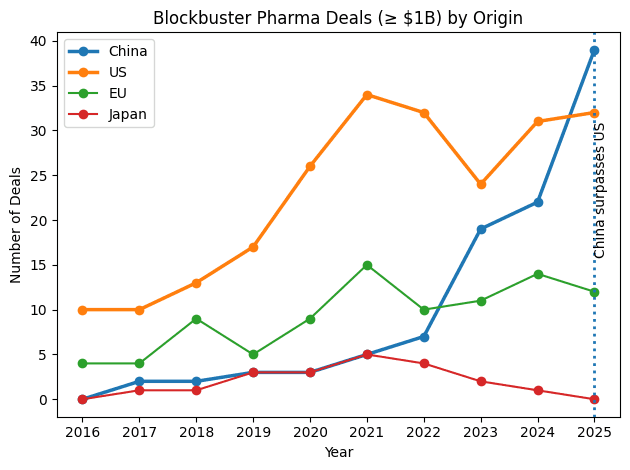

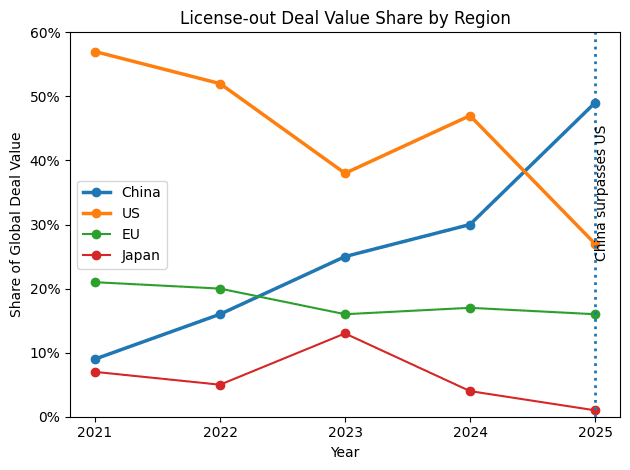

Capital Followed Execution: In 2025, China surpassed the U.S. in blockbuster deal origination (35 deals ≥$1B vs. 33–34 in the U.S.). China’s share of global license-out deal value reached ~50% in 2025, while the U.S. fell to ~27–28%. Today, one-third of new compounds in U.S. pharma pipelines originate from Chinese companies. Total Chinese out-licensing value reached a record $135.7B for the full year 2025—nearly triple the $51.9B from 2024.

$5.6B AbbVie–RemeGen Biosciences licensing deal for a PD-1/VEGF bispecific ($650M upfront).

$1.6B+ Novartis–SciNeuro Pharmaceuticals agreement for Alzheimer’s antibody candidates ($165M upfront).

$1.17B AbbVie–Zejing trispecific T-cell engager program ($100M upfront).

$50M upfront Novartis–PepLib radioligand therapy deal.

The Underlying Production Collapse: This innovation surge is the mirror image of a U.S. production shift. U.S. domestic pharmaceutical manufacturing market share fell from 83% in 2002 to 37.1% by 2024. The U.S. now accounts for only 3% of new API filings, compared to China’s 45%. Across total active API filings, India holds 48%, China 18%, and the U.S. has eroded to just 8%.

One thing is clear. If the United States does not get its priorities on track quickly, Biotech may go the way of the semiconductor, the GPU, and the electric car.

Read More

Newletter & More

SynBioBeta

Join the innovators shaping the future with SynBio + AI. From health to ag, materials & more—be part of the revolution.