Biomanufacturing Scale Up

Resilience Secures Up to $825 Million Financing to Enhance CDMO Operations

National Resilience is set to accelerate its manufacturing capabilities with significant new funding from Oak Hill Advisors.

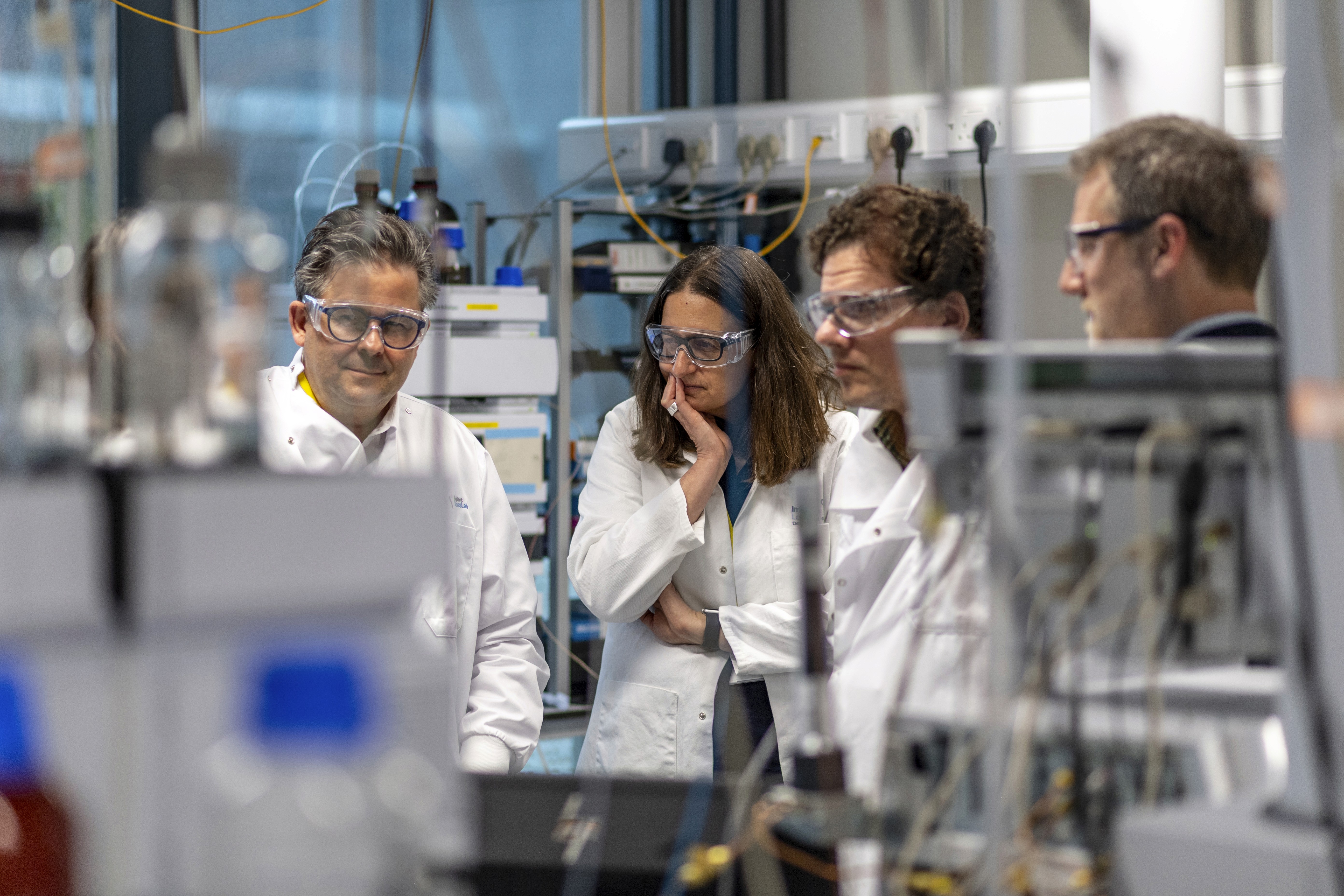

National Resilience (“Resilience”), a biomanufacturing company focused on advancing access to complex medicines, has announced a significant long-term debt financing of up to $825 million from Oak Hill Advisors (“OHA”). This funding aims to bolster Resilience's balance sheet and support its growth initiatives, particularly in its contract development and manufacturing organization (CDMO) strategy. The capital will facilitate investment in manufacturing operations based in Cincinnati and Toronto.

This financing highlights Resilience’s vital role in producing sterile drugs at scale domestically. OHA, with over thirty years of investment experience, has a strong history of fostering growth within the life sciences sector. Resilience is concentrating on high-growth areas in the biopharmaceutical market to enhance cell-based medicines, especially biologics, and aseptic drug product manufacturing. The company is currently expanding its Cincinnati facility to become one of North America’s largest and most sophisticated sterile injectable and device assembly and packaging operations.

William S. Marth, President and Chief Executive Officer of Resilience, remarked, “This financing is a pivotal step forward for our enterprise and positions us well to advance our ongoing transformation efforts backed by favorable industry tailwinds in the CDMO sector. This new capital will support the continued buildout of our core manufacturing operations and enable us to serve our customers with stability and excellence into the future, particularly at a time when pharmaceutical onshoring is a national priority. Partnering with OHA and our supportive long-time shareholders, we are confident that Resilience now has the right focus, footprint and financial profile to capitalize on the exciting strategic growth opportunities ahead.”

Joe Goldschmid, Managing Director at OHA, added, “We believe Resilience is uniquely positioned to scale its advanced manufacturing capabilities and meet the increasing demand for complex medicines. Our investment reflects conviction in the company’s leadership team, strategic positioning and ability to generate long-term value in a sector undergoing rapid transformation. We look forward to supporting Resilience as it expands its footprint and strengthens its role in the global biomanufacturing ecosystem.”

The financing package includes a $600 million first lien commitment from OHA, with an initial tranche of $525 million expected to be funded in the fourth quarter, while the remainder will be available in subsequent years as needed. This financing is contingent upon meeting standard conditions.

In addition to securing the new term loan, Resilience has successfully addressed lease obligations related to its underutilized sites, enhancing its balance sheet further.

Jefferies LLC is acting as financial advisor, and Kirkland & Ellis LLP is serving as legal counsel to Resilience in this financing transaction.